What are the monetary damages that should be awarded to the owner of an infringed patent? Under the rule of apportionment, established over one hundred years ago, a patentee is not necessarily entitled to the entirety of an infringer’s profits. Instead, courts award a “reasonable royalty” based on the value that is specifically attributable to the patented feature. The “reasonable royalty” is equal to the product of a “royalty base” and a “royalty rate”. However, selection of the royalty base has proven to be a contentious topic in recent years. In particular, some contend that the “smallest salable patent-practicing unit”, or SSPPU, should be selected as the royalty base. In this series of articles, we examine the history of apportionment and the emergence of the SSPPU.

Apportionment under Garretson v. Clark

Apportionment under Garretson v. Clark

U.S. Courts provide two basic types of remedies to the owners of valid and infringed patents: injunctions and monetary damages.

Monetary damages are typically calculated under the rule of apportionment, established in 1884 by the U.S. Supreme Court. In Garretson v. Clark, the patentee had invented an improved mop head for more easily replacing an old mop.[1] The patentee sued an infringing mop-maker, won the case, and attempted to recover money damages equal to the entirety of the infringer’s profits. But the trial court ruled that the patentee was only entitled to the profits that could be attributed to the patented feature.

The Supreme Court agreed, stating that “it could not be pretended that the entire value of the mop head was attributable to the feature patented”. The modern rule of apportionment – in which the patented feature is central to the damages inquiry – can be traced back at least as far as Garretson.

Reasonable Royalties

The rule of apportionment set forth in Garretson lived on in the Patent Act of 1952, which defined a reasonably royalty as the minimum award for an owner of an infringed patent.[2]

Courts have calculated a reasonable royalty as being the product of two variables: a royalty base and a royalty rate. In step #1 of the damages inquiry, the court identifies an infringing item that includes the patented feature (the base), and in step #2, the court determines what percentage of the infringing item’s value is attributable to the patented feature (the rate).

Suppose that we attempt to apply this framework to the facts of Garretson. As for step #1, all parties seemed to agree that the mop was the royalty base. The controversy arose in step #2, where the patentee demanded all of the profits arising from mop sales, but was forced to settle for something less.

As we will see, step #1 of the inquiry is not always so simple. Modern products, such as smartphones, may include a multitude of components sourced from a variety of suppliers. These components may be bundled in an obvious manner, or combined in clever ways to achieve unforeseen advantages. In cases such as these, the selection of the royalty base can be complicated.

Selection of the Royalty Base

Selection of the Royalty Base

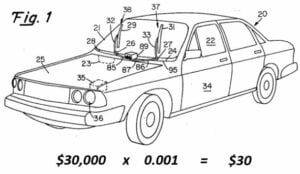

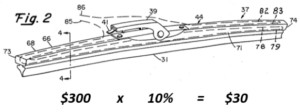

To provide an example, imagine a car that uses a patented windshield wiper technology. In an infringement suit against a car manufacturer, should the car be considered the royalty base, or should the wiper system be considered the royalty base? Does it matter?

At first glance, it doesn’t seem to matter what royalty base is selected in step #1, because a proper evaluation of the royalty rate in step #2 should lead to the correct award. For example, suppose that the car, having a value of $30,000, is selected as the base. A jury might determine that 0.1% of the value of the car is attributable to the patented feature. A reasonable royalty in this case would be $30. Alternatively, suppose that the wiper system, having a value of $300, is selected as the base, and that 10% of the value of the wiper system is attributable to the patented feature. As a matter of arithmetic, we arrive at the same number – $30 – regardless of which royalty base is selected.

However, some have suggested that big numbers have a tendency to mislead juries.[3] For example, psychologists have theorized that an evaluator tasked with estimating a correct value is biased by an initial suggestion of that value.[4] According to this theory of cognitive bias, known as anchoring, a value proposed at the outset of a negotiation tends to stick, even as the evaluator attempts to adjust the estimate based on other factors.

However, some have suggested that big numbers have a tendency to mislead juries.[3] For example, psychologists have theorized that an evaluator tasked with estimating a correct value is biased by an initial suggestion of that value.[4] According to this theory of cognitive bias, known as anchoring, a value proposed at the outset of a negotiation tends to stick, even as the evaluator attempts to adjust the estimate based on other factors.

Consider the previous example of the infringement suit against the car manufacturer, in which the $300 wiper system is selected as the royalty base and the jury arrives at a royalty of $30. The theory of anchoring predicts that in an alternate universe, where the $30,000 car is selected as the royalty base, the jury would struggle with the downward adjustment, and arrive at a royalty that is significantly greater than $30. If the theory of anchoring is correct, then selection of a larger base will result in a higher award. In such a case, the patentee would prefer that the car be selected as the royalty base, and the infringer would prefer that the wiper system be selected.

Are juries affected by anchoring? And what, if anything, should anything be done about it? As will be discussed in forthcoming articles, the courts have wrestled with these issues. In a 2009 decision, Cornell University v. Hewlett-Packard, the Northern District of New York ruled that a royalty base should be selected based on the “Smallest Salable Patent Practicing Unit”, or SSPPU.[5] The Federal Circuit seems to have embraced the idea no later than 2012, ruling in LaserDynamics , Inc. v. Quanta Computer, Inc. that selection of the SSPPU as royalty base is “generally required”.[6] Given the realities of modern supply chains, where hundreds of subcomponents may be covered by thousands of patents, there is no doubt that the concept of SSPPU will continue to play a pivotal role in patent infringement cases.

References

[1] Garretson v. Clark, 111 U.S. 120 (1884). [2] 35 U.S.C. § 284. [3] Gretchen B. Chapman & Brian H. Bornstein, “The More You Ask For, the More You Get: Anchoring in Personal Injury Verdicts”. Applied Cognitive Psychology, Vol. 10, Issue 6 pp. 519-540 (Dec 1996). [4] Amos Tversky & Daniel Kahneman, “Judgment under Uncertainty: Heuristics and Biases”. Science, Vol. 185, Issue 4157, pp. 1124-1131 (27 Sep 1974). [5] Cornell Univ. v. Hewlett-Packard Co., 609 F. Supp. 2d 279 (N.D.N.Y. 2009). [6] LaserDynamics, Inc. v. Quanta Computer, Inc., 694 F.3d 51 (Fed. Cir. 2012).